A Present Act is a legitimately binding document that promotes the transfer of ownership of a property from one person (benefactor) to another (beneficiary) without any financial exchange. This method of home transfer is generally utilized among member of the family and charitable companies. However, to guarantee its validity, it has to stick to certain lawful demands, consisting of appropriate documents and enrollment.

Legal Framework Governing Present Acts

The Transfer of Home Act, 1882, controls Gift Actions in India. According to Area 122, a legitimate Gift Deed must include a volunteer transfer without coercion, fraud, or undue impact. The benefactor should be legally experienced, suggesting they should be of sound mind and over 18 years of age. The recipient, on the other hand, can be an individual, a legal entity, or a philanthropic organization.

A Gift Deed can be implemented for both movable and immovable buildings. While movable possessions like cash, jewelry, and stocks do not require required enrollment, stationary residential or commercial properties such as land, houses, or industrial areas should be signed up with the Sub-Registrar’s Workplace.you can find more here Iowa Quit Claim Deed full walkthrough from Our Articles The beneficiary must approve the gift while the contributor is still active for the transfer to be lawfully valid.

Just how to Prepare and Implement a Present Action?

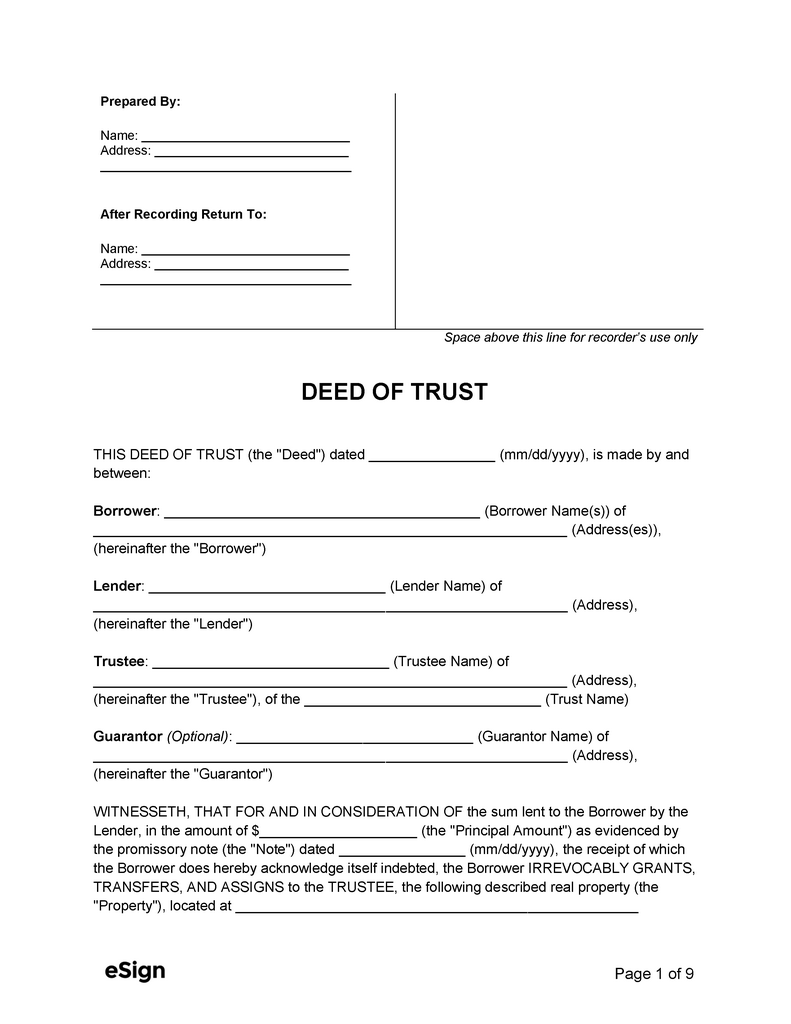

A Gift Deed must include the following necessary stipulations:

- Details of Donor & Donee – Complete name, address, and connection (if any kind of).

- Description of the Gifted Property – Exact information of the residential property being talented.

- Volunteer Nature of the Gift – Verification that the benefactor is gifting willingly.

- Acceptance Provision – A statement that the donee has approved the present.

- See Signatures – Two witnesses must authorize the act.

Enrollment of Present Action

As per the Registration Act, 1908, a Gift Action for stationary home must be signed up at the Sub-Registrar’s Workplace. Steps for Registration:

- Prepare the Gift Deed with the help of a legal representative.

- Pay Stamp Responsibility (varies by state, typically 2% to 5% of the property value).

- Check out the Sub-Registrar’s Office with required papers.

- Sign the Action in Visibility of the Registrar.

When signed up, the recipient ends up being the legal proprietor of the home.

Tax obligation Implications of a Gift Action

Tax on gifted home relies on the partnership between the donor and donee. Under Section 56( 2) of the Revenue Tax Obligation Act, 1961, gifts got from specified loved ones, such as parents, spouse, youngsters, and siblings, are exempt from tax obligation. Nevertheless, if a present is gotten from a non-relative and exceeds 50,000 in worth, it is treated as revenue and is taxed under ‘Earnings from Various Other Resources.’

One more critical element is Funding Gains Tax. Although the donor does not pay funding gains tax at the time of gifting, the Beneficiary becomes responsible for resources gains tax obligation when they determine to market the gifted residential property. The tax is computed based upon the initial procurement expense paid by the benefactor.

Verdict

A Present Act is a protected and legitimately identified method for moving building without monetary exchange. Nonetheless, proper documents, enrollment, and tax obligation considerations are essential to make sure a hassle-free transfer. Looking for legal aid can aid in composing a Present Action properly and avoiding future disagreements.

If you are taking into consideration gifting residential property to a liked one, guarantee you follow the legal process carefully to prevent any kind of legal or economic issues. Consulting a real estate expert or lawful consultant can help navigate the intricacies associated with Present Acts and make certain a smooth property transfer process.